"The house should be the case of life, the machine of happiness"

Le Corbusier.

DECORA SA

TICKER: DCR

Have you noticed the floors they put in new apartments and renovations?

Parquet imitation.

-Well, this is what happens in Spain. I don't know about your country, but I can imagine it's more or less the same.-

Natural parquet, made of wood, is expensive and requires maintenance.

Synthetic is beautiful, resistant, and very convincing.

I love parquet floors, although I have a theory that we are on the verge of a turning point for this decorative style. In a decade, we will think that synthetic parquet is tacky. Cheap renovations are to blame. They call it a "facelift" in Spanish industry. Cheap synthetic parquet at will. Over time, we will associate parquet with cheap. And cheap in decoration is a sin.

But until that fateful day arrives, we have a Polish company to invest in. They manufacture parquet. Synthetic. The kind that's being put everywhere.

Decora has given the S&P 500 a good beating over the past two years, + 132%. Spectacular revaluations are not only in the United States. Poland also exists.

FUNDAMENTAL

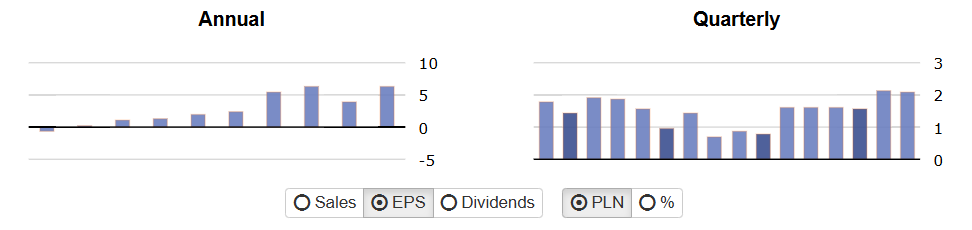

The fundamentals are excellent. Sales are growing. Earnings per share are sustained and trending upwards across the board.

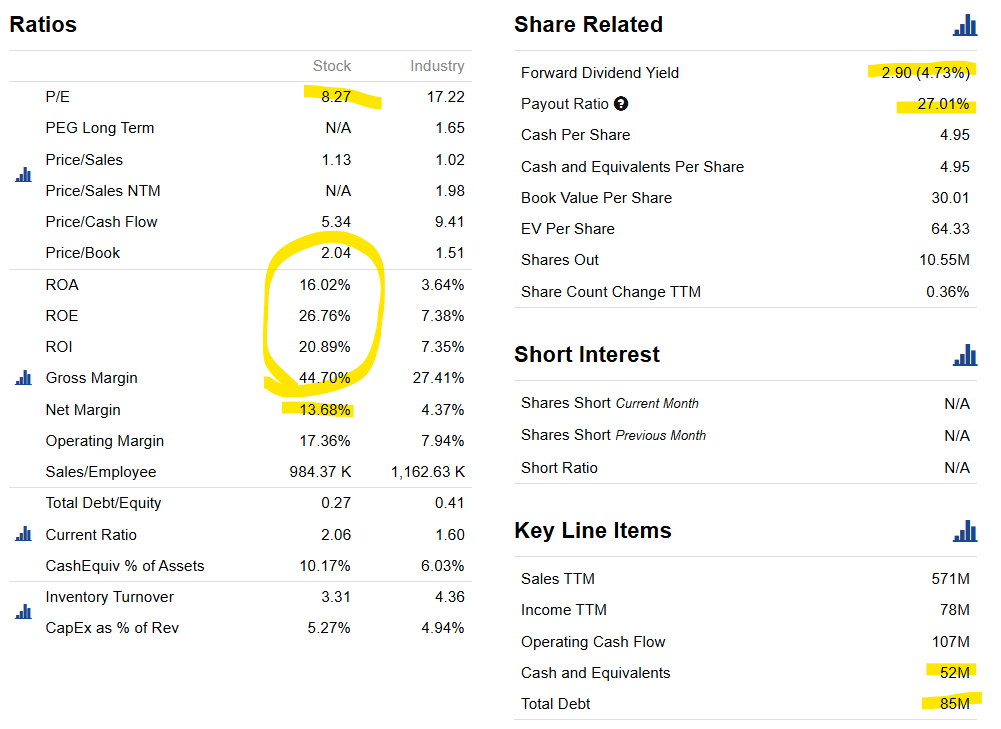

The rest of the ratios are very good as well. It's cheap no matter how you look at it. With returns on invested capital far above the industry average. Excellent net margins. Manageable debt.

One of the best aspects of this company is that it has an excellent dividend yield of almost 5%. It seems like a very healthy and sustainable dividend over time. The current payout ratio is 27%.

TECHNICAL ANALYSIS

In the long term, we have had a large and sustained rise since 2016. I suppose it's when people started to go crazy for synthetic parquet flooring.

In the medium term, it appears that the stock tends to consolidate in sideways ranges, before continuing to rise.

It broke out of its trading range, making new highs with good volume on September 27, only to retreat to the previous zone. Perhaps waiting for it to return to the 66 Polish Zloty level could be an optimal entry strategy.

CYCLES

The cycles look bad in the short term. They predict a decline until January 2025. Possible rises at the end of February of the same year and also in September 2025

CONCLUSION

I'll add Decora to the second portfolio, and in a few months we'll see how it goes. We're missing three companies and then we'll close it.

In the next article, we'll cover the next one.

If you liked the article and feel generous, please share this newsletter with others.

Best.

Jaume.