"Living is like visiting a museum: it's afterwards that you begin to understand what you've seen."

Audrey Hepburn.

PORTFOLIO

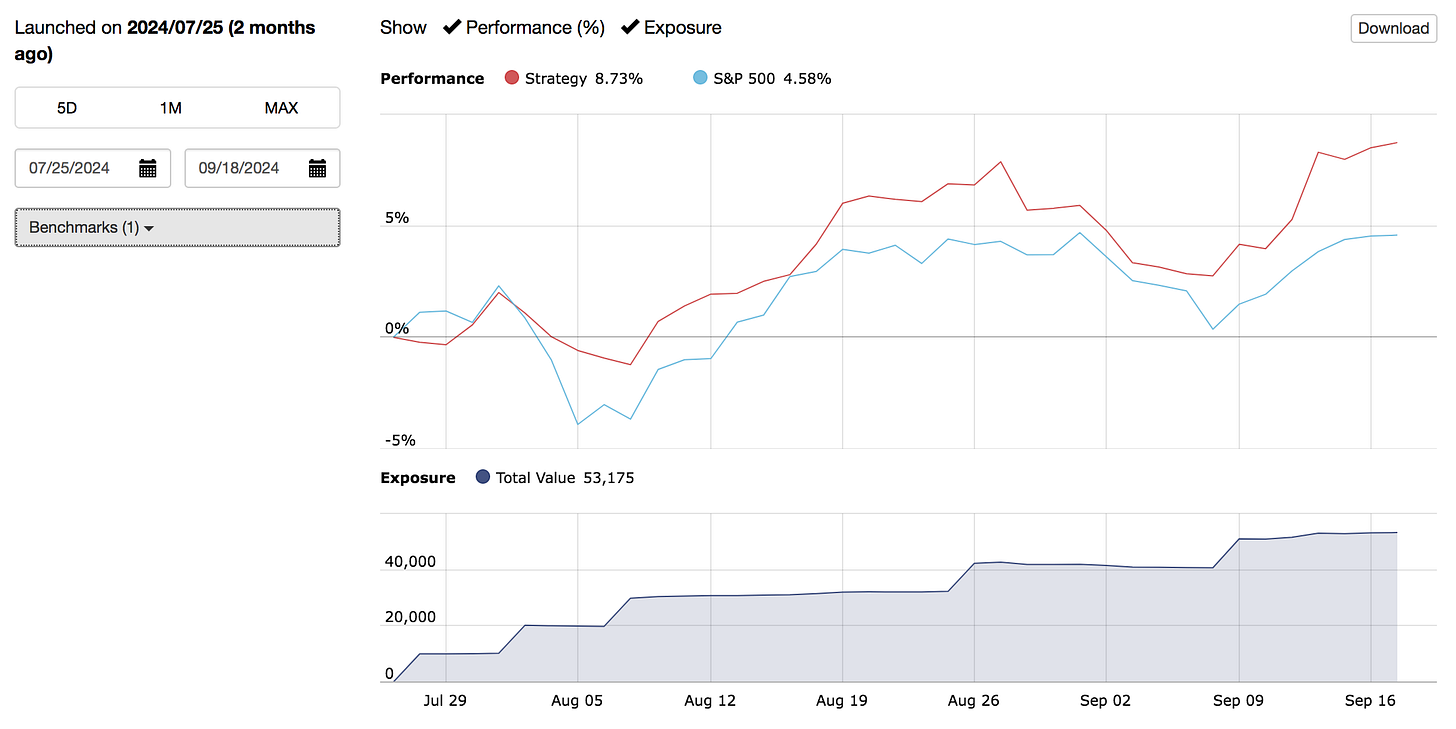

I restarted this newsletter about two months ago. Since then, I've brought you five investment ideas. Today, we'll see how they've performed, compare them to the S&P 500's performance over the same period, and that's it.

I like comparing everything to the S&P 500. I know it makes no sense to compare a portfolio of Turkish kebab companies, for example, to an index of the 500 largest US companies.

It's like comparing apples to oranges. Or kebabs to apples.

But we invest to make money. Not to compare things. Comparing things isn't the goal. Making money is the goal.

I compare it to the S&P 500 because it's a very cheap asset to buy. Very easy to trade. And it has an excellent past performance.

By comparing my portfolio against the S&P 500, I answer the question: Am I being an idiot?

It's an important question.

If you're buying, selling, paying commissions, and spending hundreds of hours managing a portfolio that doesn't beat the S&P 500, yes, you're being an idiot.

Buy the S&P 500 and spend your time on something else.

It would be like picking an apple from your garden to eat it or going to China, stealing an apple from a store, escaping from the Chinese, tripping over a dog while fleeing, ending up on the ground hastily nibbling half an apple while waiting for the Chinese to catch you and beat you up.

You wanted an apple, right? Well, you've been an idiot. It was easier to pick one from your garden.

It's the same in investing.

THE DETAIL

The portfolio with the five companies is performing very well, almost doubling the S&P 500 with less volatility. It has returned 9% in these couple of months.

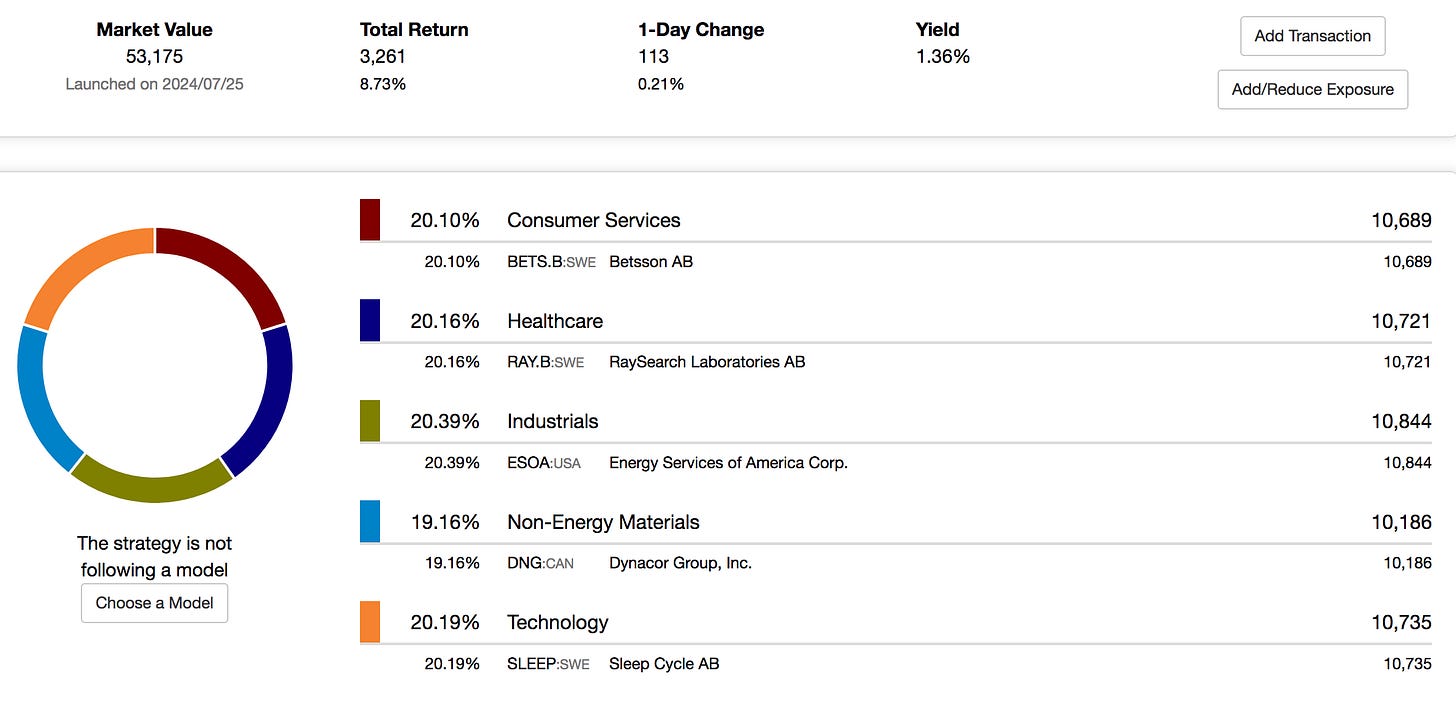

It has ended up quite diversified by sector, without any planning. One company per sector.

Fundamentally, there is also a variety of companies. Some are 'expensive', most are 'cheap', without falling into the 'deep value' category.

All are profitable, with low debt and good returns on capital. There are even a couple with dividend yields of 3%.

SO, WHAT’S NEXT?

I've always thought that 30-stock portfolios are way too much. I like to keep it simple with less than 10.

The big problem with small portfolios is that they're too volatile. On the other hand, it's easier to follow a smaller group of stocks.

Five is my magic number. I can keep track of them without breaking a sweat.

I've always felt that most fund managers are set up to fail. They're forced to manage huge portfolios with 50 stocks or more. How are you supposed to pick 50 winners that beat the index?

It's crazy, especially now that everyone's just throwing money into index funds.

What makes prices go up?

People buying.

But what happens when there are fewer people buying (future population decline in western countries)? Ooopppsss….

That's the big question.

Will everything get cheaper? Will we enter a long-term bear market when the Boomers start selling everything in order to pay for the golden retirement?

I don't have all the answers. But regarding to this Newsletter, I'll be focusing on smaller, more manageable portfolios.

I'll be tracking these 5-stock portfolios from time to time, and longer as a year, for instance.

Will they have very different returns from one portfolio to another?

Will they beat the S&P 500?

Is stock picking dead?

We will see.

FINAL NOTES

The photo of the Chinese people running, with the guy who looks like Xi Jinping, was created using AI.

I generated it on my first try. With a shitty sentence. Using a random AI tool I found online. For free.

The future is going to be fascinating.

Best regards to everyone.

If you enjoyed this article, please be generous and share it.